How Long Will You Live?

This new longevity calculator, courtesy of the University of Connecticut, is one of the best I’ve encountered to date. Given your estimated longevity is the most influential factor in determining your future spending capacity, I hope you all will give it a whirl. This is an example of big data providing useful results.

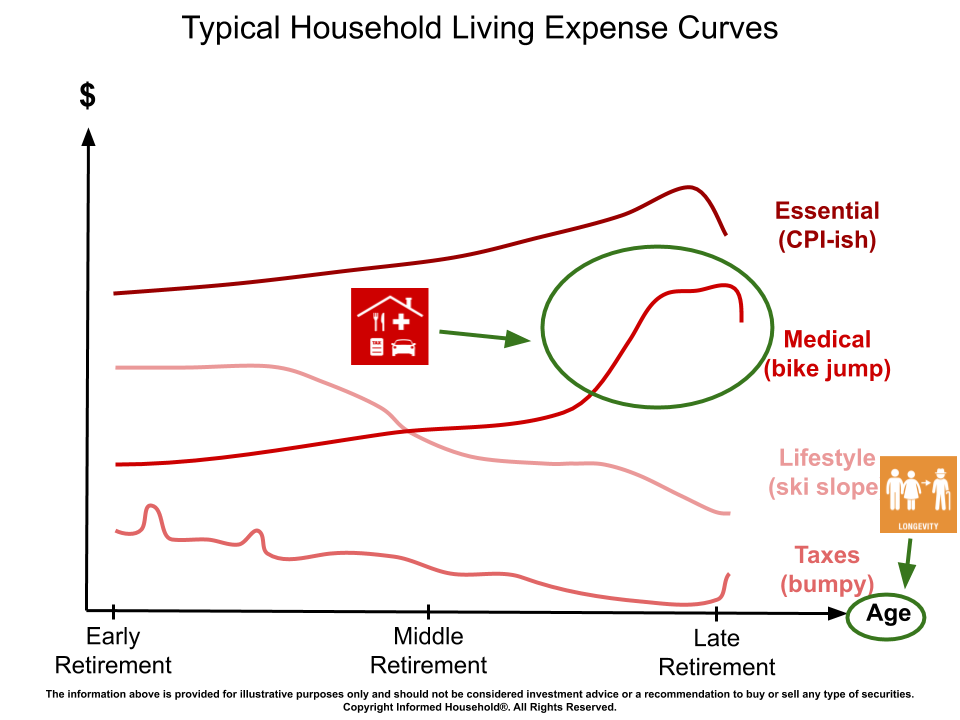

How Much Does Healthcare Cost?

This interactive website, courtesy of Genworth, will help you estimate you future medical spending. It provides the latest cost statistics by state for later-in-life home health care, assisted living and nursing care. Please remember that the typical household incurs the bulk of their medical expenses late-in-life which makes budgeting difficult if you have a long lifespan ahead of you.

The Informed Household’s typical expense curve graphic above reminds us that (1) your (and your spouse’s) lifespan significantly impacts all retirement expense categories so please re-evaluate and refine this crucial planning estimate annually. And (2) your medical costs in retirement do NOT trend smoothly up at the general rate of inflation; these expenses tend to spike late-in-life as you approach the pearly gates.

For more information estimating your future medical spending, please see this video, and for a broader discussion on future retirement risks, please watch this video.

I will also add these two calculator links to the “Suggested Third-Party Resources” section of the Informed Household knowledge wall.

Cheers…..Jim

About Jim Koch

Jim Koch is the President of Koch Capital Management, an independent Registered Investment Advisor (RIA), and the Founder and Principal of the Informed Household® financial education and smart budgeting website located in the San Francisco Bay Area. As a fiduciary, he specializes in providing customized financial solutions to individuals, families, trusts and business entities so they are better able to achieve their financial goals. Jim sees himself as an “implementer” of financial innovation, using state-of-the-art technology to provide practical investment management and retirement planning solutions for clients.

General Disclosure

This information is provided for informational/educational purposes only. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions. Nothing presented herein is or is intended to constitute advice to use or buy any of third-party applications presented here, and no purchase decision should be made based on any information provided herein. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Third Party Information

While Koch Capital has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, timeliness, or completeness of third party information presented herein. Any third party trademarks appearing herein are the property of their respective owners. At certain places on this website, live ‘links’ to other Internet addresses can be accessed. Koch Capital does not endorse, approve, certify, or control the content of such websites, and does not guarantee or assume responsibility for the accuracy or completeness of information located on such websites. Any links to other sites are not intended as referrals or endorsements, but are merely provided for convenience and informational purposes. Use of any information obtained from such addresses is voluntary, and reliance on it should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness.

I recently updated the Informed Household Infographic PDF from its original 2-page format to an expanded 4-page format to include more details on the nine funding profile types. The additional pages address the lifestyle risk priorities for each funding profile type as well as provide the typical discretionary vs. essential expense curves retirees normally experience during their lifespans.

Now it’s all in one place, in one PDF available for download here. And please remember that most the graphics contained within the PDF are hyperlinked to additional video resources for your convenience.

Retirement planner and blogger Dirk Cotton gets right to the point. Retirement planning is complex and difficult to know where to start.

His recent Forbes blog post succinctly explains the basic trade-offs between the two main retirement planning camps: safety-first and probability-based. In the Informed Household parlance, this corresponds to Sleeps Like A Baby and Insanely Hopeful funding profiles.

Enjoy the the article, it’s very informative…..Jim