Welcome to your 5-minute monthly Informed Household financial tune-up.

Smart Budgeting = Simple Budgeting = Effective Budgeting

Let’s face it most people hate budgeting especially on the personal finance front. Budgeting is tedious to implement and slow to realize the benefit. However, the resulting payback, more informed financial decision making, is substantial if you stick with it. For this month’s 5-minute update, let’s see how you can get the budget process started quickly using the Informed Household balance sheet model.

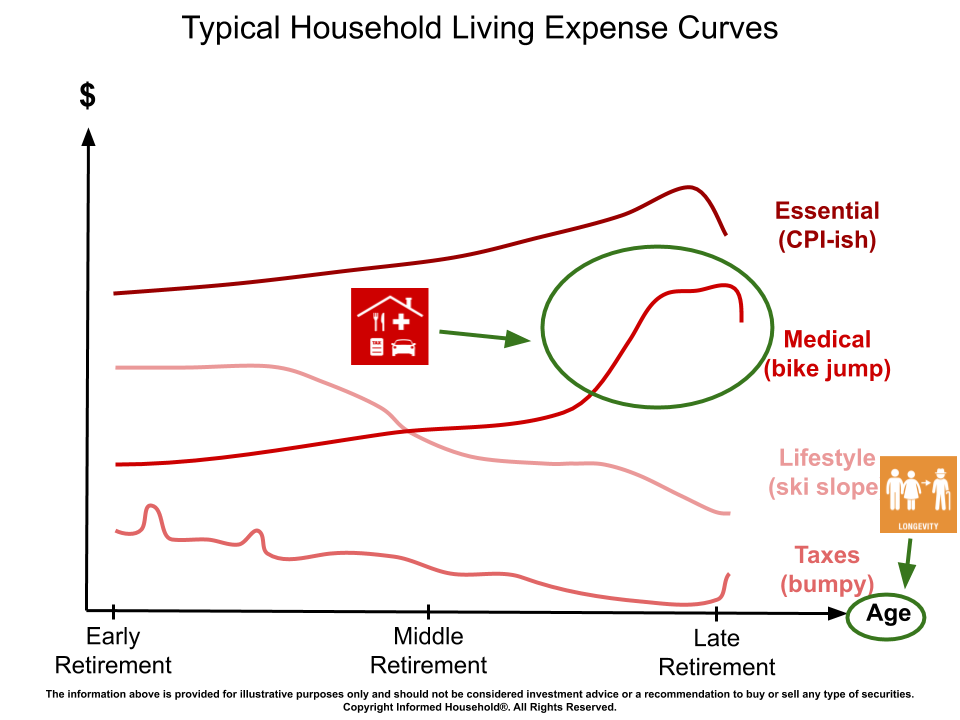

In our dashboard model assumptions page (the Scenarios input page which launches the budget model), we categorize your annual expense items as either mandatory (essential) or discretionary (lifestyle) to determine your spending priorities. We further breakout your mandatory tax and medical expenses into their own essential cost buckets. We do this because tax and medical expenses have very different lifetime cost curves (see below) than the rest of the essential living expenses like shelter, transportation, food and clothes. These traditional essential living expenses increase over time at the general US inflation rate (approximately) as reported by the Consumer Price Index (CPI).

Long Live Your Household Run Rate

If you estimate future spending based on these four recurring expense categories – Lifestyle, Taxes, Medical and Essential, then you’ll have a good spending roadmap for the rest of your life given we know the basic pattern of how each spending category evolves over your lifespan. So start with this simple formula:

Run Rate = Annual, On-going Expenses(Lifestyle+Taxes+Medical+Essential)

Run rate is your household’s annual spending bogey in retirement. As your household ages, your run rate will trend down by a percent or two per year with an uptick near the end of life, most likely from a jump in medical expenses.

The run rate field (a.k.a. your Household Annual Spending Rate) in your Informed Household Scenarios page under the Dashboard Model Assumptions section is a derived field from the four recurring expense inputs listed earlier.

If the spending is non-recurring or one-off, the model accounts for this type of expense separately. Often this what we label an educational or legacy expense which equates to a future lump sum dollar amount, or a future budget goal if you will.

Budget Strengths, Weaknesses, Opportunities & Threats (SWOT)

By knowing your (or projecting a desired household’s) run rate you can now assess it’s achievability with your current asset mix and savings preferences. By changing your lifestyle, tax, medical and essential annual living expense inputs, the model will provide you with a fundedness score (the funded ratio) of the reasonableness of funding your future living expenses in retirement.

With your projected run rate in place, you can now apply a simple form of SWOT analysis to see where there are potential budget holes and budget upsides. For example, say your household wants to spend more on fun stuff like vacations (lifestyle expenses). A quick review of the SWOT analysis section of the dashboard report shows if you increase your lifestyle expenses by 5% or 10%, your overall funded ratio is reduced but still sufficient to fund your target run rate. That’s an opportunity to spend a little more on the lifestyle items important to you without jeopardizing your overall retirement funding plan.

Likewise, if you are concerned that a large, one-time expense might derail your future retirement funding, then review the expense shock SWOT chart in your dashboard to see how much capacity you have to absorb the unexpected expense.

The two key takeaways here are (1) budgeting for retirement does not have to be overly complex to be useful and (2) you need a dynamic budget forecasting system that allows you to experiment and test new expense assumptions at will. The one certainty of budgeting for life is that your spending assumptions will always change. That’s just how life works.

Cheers…..Jim Koch (jim@informedhousehold.com)

Additional Resource Links

Jim Koch video primer on what is the funded ratio

Investopedia defining what is a discretionary (lifestyle) expense

TillerMoney for automating the tracking of your household living expenses

Michael Kitces Segmenting Retirement Expenses Into Core Vs Adaptive article

About Jim Koch

Jim Koch is the President of Koch Capital Management, an independent Registered Investment Advisor (RIA), and the Founder and Principal of the Informed Household® financial education and smart budgeting website located in the San Francisco Bay Area. As a fiduciary, he specializes in providing customized financial, budgeting and educational solutions to individuals, families, trusts and business entities so they are better able to achieve their financial goals. Jim sees himself as an “implementer” of financial innovation, using state-of-the-art technology to provide practical investment management and retirement planning advice for Koch Capital clients and effective budgeting and educational solutions for his Informed Household® clients.

General Disclosure

This information is provided for informational/educational purposes only. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions. Nothing presented herein is or is intended to constitute advice to use or buy any of third-party applications presented here, and no purchase decision should be made based on any information provided herein. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Third Party Information

While Koch Capital and the Informed Household have used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, timeliness, or completeness of third party information presented herein. Any third party trademarks appearing herein are the property of their respective owners. At certain places on this website, live ‘links’ to other Internet addresses can be accessed. Neither Koch Capital nor the Informed Household endorse, approve, certify, or control the content of such websites, and do not guarantee or assume responsibility for the accuracy or completeness of information located on such websites. Any links to other sites are not intended as referrals or endorsements, but are merely provided for convenience and informational purposes. Use of any information obtained from such addresses is voluntary, and reliance on it should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness.

How Long Will You Live?

This new longevity calculator, courtesy of the University of Connecticut, is one of the best I’ve encountered to date. Given your estimated longevity is the most influential factor in determining your future spending capacity, I hope you all will give it a whirl. This is an example of big data providing useful results.

How Much Does Healthcare Cost?

This interactive website, courtesy of Genworth, will help you estimate you future medical spending. It provides the latest cost statistics by state for later-in-life home health care, assisted living and nursing care. Please remember that the typical household incurs the bulk of their medical expenses late-in-life which makes budgeting difficult if you have a long lifespan ahead of you.

The Informed Household’s typical expense curve graphic above reminds us that (1) your (and your spouse’s) lifespan significantly impacts all retirement expense categories so please re-evaluate and refine this crucial planning estimate annually. And (2) your medical costs in retirement do NOT trend smoothly up at the general rate of inflation; these expenses tend to spike late-in-life as you approach the pearly gates.

For more information estimating your future medical spending, please see this video, and for a broader discussion on future retirement risks, please watch this video.

I will also add these two calculator links to the “Suggested Third-Party Resources” section of the Informed Household knowledge wall.

Cheers…..Jim

About Jim Koch

Jim Koch is the President of Koch Capital Management, an independent Registered Investment Advisor (RIA), and the Founder and Principal of the Informed Household® financial education and smart budgeting website located in the San Francisco Bay Area. As a fiduciary, he specializes in providing customized financial solutions to individuals, families, trusts and business entities so they are better able to achieve their financial goals. Jim sees himself as an “implementer” of financial innovation, using state-of-the-art technology to provide practical investment management and retirement planning solutions for clients.

General Disclosure

This information is provided for informational/educational purposes only. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions. Nothing presented herein is or is intended to constitute advice to use or buy any of third-party applications presented here, and no purchase decision should be made based on any information provided herein. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Third Party Information

While Koch Capital has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, timeliness, or completeness of third party information presented herein. Any third party trademarks appearing herein are the property of their respective owners. At certain places on this website, live ‘links’ to other Internet addresses can be accessed. Koch Capital does not endorse, approve, certify, or control the content of such websites, and does not guarantee or assume responsibility for the accuracy or completeness of information located on such websites. Any links to other sites are not intended as referrals or endorsements, but are merely provided for convenience and informational purposes. Use of any information obtained from such addresses is voluntary, and reliance on it should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness.

I recently updated the Informed Household Infographic PDF from its original 2-page format to an expanded 4-page format to include more details on the nine funding profile types. The additional pages address the lifestyle risk priorities for each funding profile type as well as provide the typical discretionary vs. essential expense curves retirees normally experience during their lifespans.

Now it’s all in one place, in one PDF available for download here. And please remember that most the graphics contained within the PDF are hyperlinked to additional video resources for your convenience.