The Informed Household® recently rolled out version 1.2 of its dashboard balance sheet report. Updates include the following:

New Copy URL Tool For Report Sharing

Informed Household® subscribers can share their reports with any trusted third-party or individual by emailing them the dashboard Uniform Resource Locator (URL) web address. The report sharing functionality was already in the code base, this feature makes it more convenient to use.

Since each dashboard report is its own mini-webpage with a unique URL web address, subscribers can access their reports from any browser as well as any person who knows the unique URL address. The URL string is very long, complex and can’t be randomly re-produced, so copy and paste is the only way to ensure the third-party in question receives the correct report URL address. Informed Household® support uses this feature when reviewing dashboard report output with subscribers in virtual meetings.

New SWOT Analysis Report Section

Previously, this feature was available to premium subscribers only. However, since Strengths, Weaknesses, Opportunities and Threats (SWOT) analysis is so impactful when analyzing retirement funding (Funded Ratio) risks and rewards, we decided to make it available to all Informed Household® subscribers with this new release.

New Comment Fields On Dashboard Model Assumptions Page

Finally, in the Scenarios page of the Informed Household® website (you must be logged in to access), we added comment user fields to attach short notes to each of the 29 model assumption fields if desired. When running scenario reports, we found that short notes can be helpful when experimenting with multiple assumption variable changes.

Subscriber feedback made these updates possible, so please keep it coming.

If you sign up before year end (2019), new subscribers receive the first 30 days free (trial period), then pay an introductory price of $49 per year if you choose to proceed with a basic Informed Household® subscription.

Cheers…..Jim

About Jim Koch

Jim Koch is the President of Koch Capital Management, an independent Registered Investment Advisor (RIA), and the Founder and Principal of the Informed Household® financial education and smart budgeting website located in the San Francisco Bay Area. As a fiduciary, he specializes in providing customized financial solutions to individuals, families, trusts and business entities so they are better able to achieve their financial goals. Jim sees himself as an “implementer” of financial innovation, using state-of-the-art technology to provide practical investment management and retirement planning solutions for clients.

General Disclosure

This information is provided for informational/educational purposes only. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions. Nothing presented herein is or is intended to constitute advice to use or buy any of third-party applications presented here, and no purchase decision should be made based on any information provided herein. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Third Party Information

While Koch Capital has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, timeliness, or completeness of third party information presented herein. Any third party trademarks appearing herein are the property of their respective owners. At certain places on this website, live ‘links’ to other Internet addresses can be accessed. Koch Capital does not endorse, approve, certify, or control the content of such websites, and does not guarantee or assume responsibility for the accuracy or completeness of information located on such websites. Any links to other sites are not intended as referrals or endorsements, but are merely provided for convenience and informational purposes. Use of any information obtained from such addresses is voluntary, and reliance on it should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness.

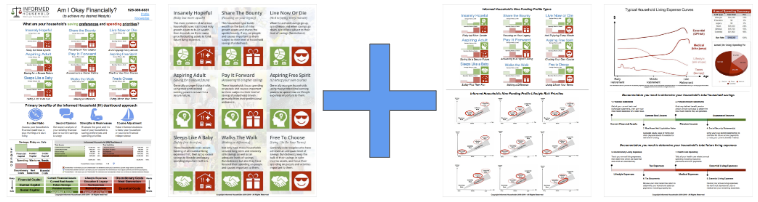

I recently updated the Informed Household Infographic PDF from its original 2-page format to an expanded 4-page format to include more details on the nine funding profile types. The additional pages address the lifestyle risk priorities for each funding profile type as well as provide the typical discretionary vs. essential expense curves retirees normally experience during their lifespans.

Now it’s all in one place, in one PDF available for download here. And please remember that most the graphics contained within the PDF are hyperlinked to additional video resources for your convenience.