Welcome to your 5-minute monthly Informed Household financial tune-up.

Smart Budgeting = Simple Budgeting = Effective Budgeting

Let’s face it most people hate budgeting especially on the personal finance front. Budgeting is tedious to implement and slow to realize the benefit. However, the resulting payback, more informed financial decision making, is substantial if you stick with it. For this month’s 5-minute update, let’s see how you can get the budget process started quickly using the Informed Household balance sheet model.

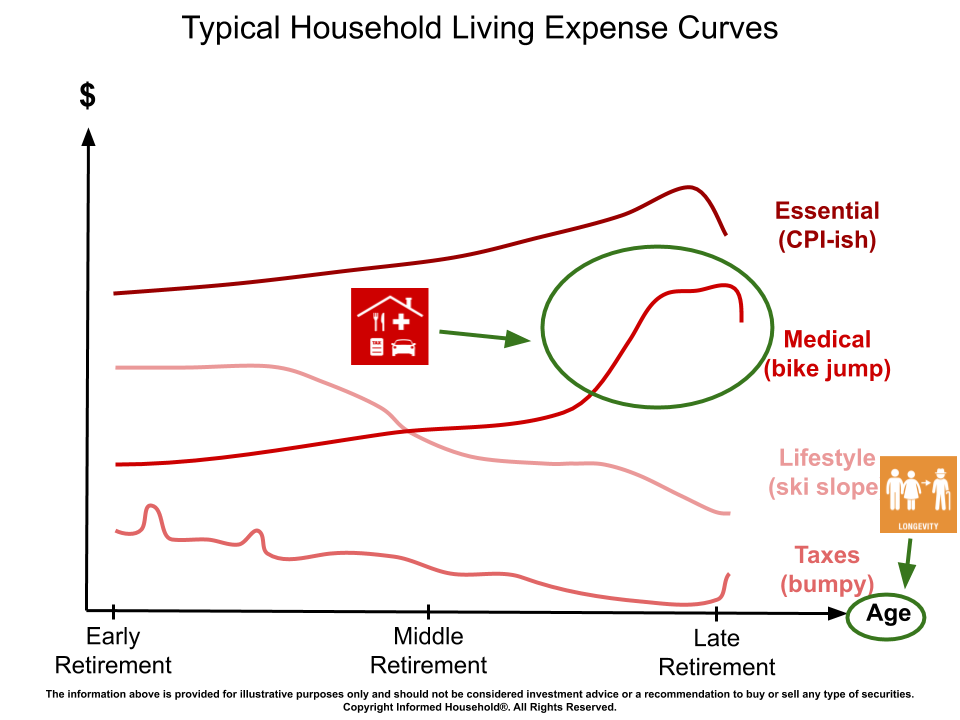

In our dashboard model assumptions page (the Scenarios input page which launches the budget model), we categorize your annual expense items as either mandatory (essential) or discretionary (lifestyle) to determine your spending priorities. We further breakout your mandatory tax and medical expenses into their own essential cost buckets. We do this because tax and medical expenses have very different lifetime cost curves (see below) than the rest of the essential living expenses like shelter, transportation, food and clothes. These traditional essential living expenses increase over time at the general US inflation rate (approximately) as reported by the Consumer Price Index (CPI).

Long Live Your Household Run Rate

If you estimate future spending based on these four recurring expense categories – Lifestyle, Taxes, Medical and Essential, then you’ll have a good spending roadmap for the rest of your life given we know the basic pattern of how each spending category evolves over your lifespan. So start with this simple formula:

Run Rate = Annual, On-going Expenses(Lifestyle+Taxes+Medical+Essential)

Run rate is your household’s annual spending bogey in retirement. As your household ages, your run rate will trend down by a percent or two per year with an uptick near the end of life, most likely from a jump in medical expenses.

The run rate field (a.k.a. your Household Annual Spending Rate) in your Informed Household Scenarios page under the Dashboard Model Assumptions section is a derived field from the four recurring expense inputs listed earlier.

If the spending is non-recurring or one-off, the model accounts for this type of expense separately. Often this what we label an educational or legacy expense which equates to a future lump sum dollar amount, or a future budget goal if you will.

Budget Strengths, Weaknesses, Opportunities & Threats (SWOT)

By knowing your (or projecting a desired household’s) run rate you can now assess it’s achievability with your current asset mix and savings preferences. By changing your lifestyle, tax, medical and essential annual living expense inputs, the model will provide you with a fundedness score (the funded ratio) of the reasonableness of funding your future living expenses in retirement.

With your projected run rate in place, you can now apply a simple form of SWOT analysis to see where there are potential budget holes and budget upsides. For example, say your household wants to spend more on fun stuff like vacations (lifestyle expenses). A quick review of the SWOT analysis section of the dashboard report shows if you increase your lifestyle expenses by 5% or 10%, your overall funded ratio is reduced but still sufficient to fund your target run rate. That’s an opportunity to spend a little more on the lifestyle items important to you without jeopardizing your overall retirement funding plan.

Likewise, if you are concerned that a large, one-time expense might derail your future retirement funding, then review the expense shock SWOT chart in your dashboard to see how much capacity you have to absorb the unexpected expense.

The two key takeaways here are (1) budgeting for retirement does not have to be overly complex to be useful and (2) you need a dynamic budget forecasting system that allows you to experiment and test new expense assumptions at will. The one certainty of budgeting for life is that your spending assumptions will always change. That’s just how life works.

Cheers…..Jim Koch (jim@informedhousehold.com)

Additional Resource Links

Jim Koch video primer on what is the funded ratio

Investopedia defining what is a discretionary (lifestyle) expense

TillerMoney for automating the tracking of your household living expenses

Michael Kitces Segmenting Retirement Expenses Into Core Vs Adaptive article

About Jim Koch

Jim Koch is the President of Koch Capital Management, an independent Registered Investment Advisor (RIA), and the Founder and Principal of the Informed Household® financial education and smart budgeting website located in the San Francisco Bay Area. As a fiduciary, he specializes in providing customized financial, budgeting and educational solutions to individuals, families, trusts and business entities so they are better able to achieve their financial goals. Jim sees himself as an “implementer” of financial innovation, using state-of-the-art technology to provide practical investment management and retirement planning advice for Koch Capital clients and effective budgeting and educational solutions for his Informed Household® clients.

General Disclosure

This information is provided for informational/educational purposes only. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions. Nothing presented herein is or is intended to constitute advice to use or buy any of third-party applications presented here, and no purchase decision should be made based on any information provided herein. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Third Party Information

While Koch Capital and the Informed Household have used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, timeliness, or completeness of third party information presented herein. Any third party trademarks appearing herein are the property of their respective owners. At certain places on this website, live ‘links’ to other Internet addresses can be accessed. Neither Koch Capital nor the Informed Household endorse, approve, certify, or control the content of such websites, and do not guarantee or assume responsibility for the accuracy or completeness of information located on such websites. Any links to other sites are not intended as referrals or endorsements, but are merely provided for convenience and informational purposes. Use of any information obtained from such addresses is voluntary, and reliance on it should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness.

The Informed Household® recently rolled out version 1.2 of its dashboard balance sheet report. Updates include the following:

New Copy URL Tool For Report Sharing

Informed Household® subscribers can share their reports with any trusted third-party or individual by emailing them the dashboard Uniform Resource Locator (URL) web address. The report sharing functionality was already in the code base, this feature makes it more convenient to use.

Since each dashboard report is its own mini-webpage with a unique URL web address, subscribers can access their reports from any browser as well as any person who knows the unique URL address. The URL string is very long, complex and can’t be randomly re-produced, so copy and paste is the only way to ensure the third-party in question receives the correct report URL address. Informed Household® support uses this feature when reviewing dashboard report output with subscribers in virtual meetings.

New SWOT Analysis Report Section

Previously, this feature was available to premium subscribers only. However, since Strengths, Weaknesses, Opportunities and Threats (SWOT) analysis is so impactful when analyzing retirement funding (Funded Ratio) risks and rewards, we decided to make it available to all Informed Household® subscribers with this new release.

New Comment Fields On Dashboard Model Assumptions Page

Finally, in the Scenarios page of the Informed Household® website (you must be logged in to access), we added comment user fields to attach short notes to each of the 29 model assumption fields if desired. When running scenario reports, we found that short notes can be helpful when experimenting with multiple assumption variable changes.

Subscriber feedback made these updates possible, so please keep it coming.

If you sign up before year end (2019), new subscribers receive the first 30 days free (trial period), then pay an introductory price of $49 per year if you choose to proceed with a basic Informed Household® subscription.

Cheers…..Jim

About Jim Koch

Jim Koch is the President of Koch Capital Management, an independent Registered Investment Advisor (RIA), and the Founder and Principal of the Informed Household® financial education and smart budgeting website located in the San Francisco Bay Area. As a fiduciary, he specializes in providing customized financial solutions to individuals, families, trusts and business entities so they are better able to achieve their financial goals. Jim sees himself as an “implementer” of financial innovation, using state-of-the-art technology to provide practical investment management and retirement planning solutions for clients.

General Disclosure

This information is provided for informational/educational purposes only. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions. Nothing presented herein is or is intended to constitute advice to use or buy any of third-party applications presented here, and no purchase decision should be made based on any information provided herein. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Third Party Information

While Koch Capital has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, timeliness, or completeness of third party information presented herein. Any third party trademarks appearing herein are the property of their respective owners. At certain places on this website, live ‘links’ to other Internet addresses can be accessed. Koch Capital does not endorse, approve, certify, or control the content of such websites, and does not guarantee or assume responsibility for the accuracy or completeness of information located on such websites. Any links to other sites are not intended as referrals or endorsements, but are merely provided for convenience and informational purposes. Use of any information obtained from such addresses is voluntary, and reliance on it should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness.

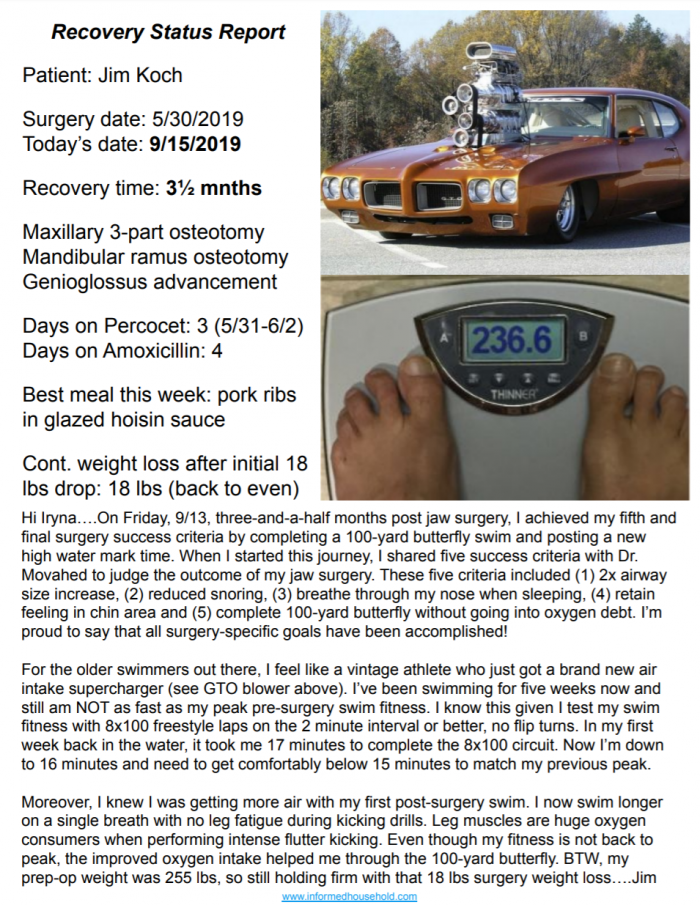

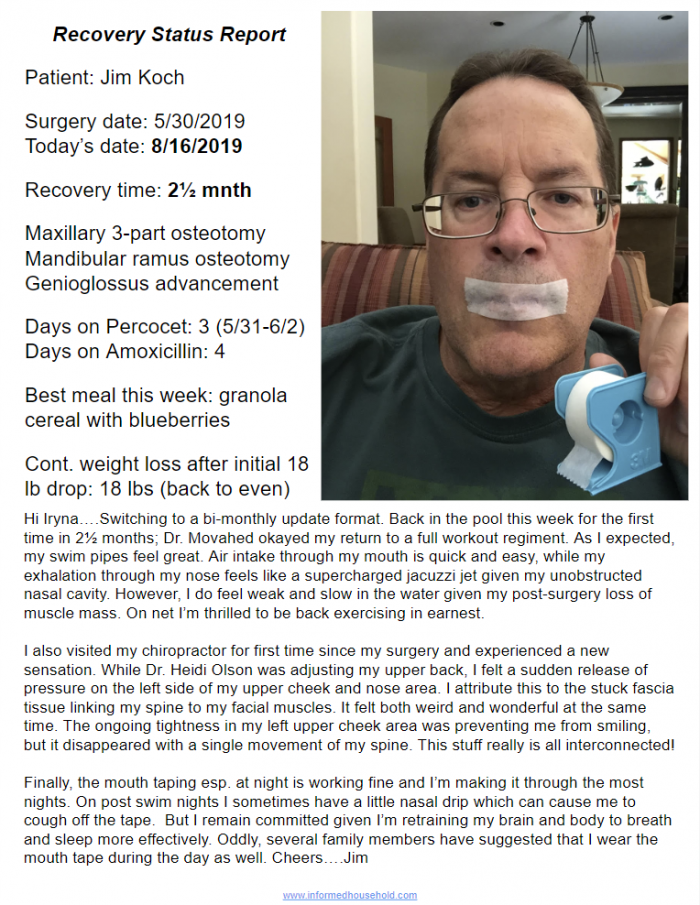

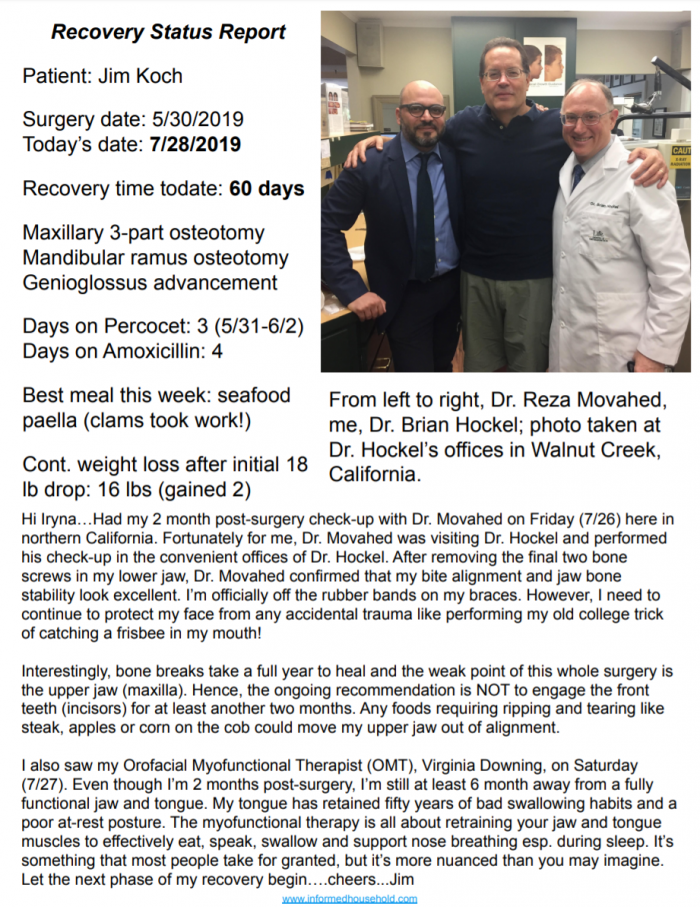

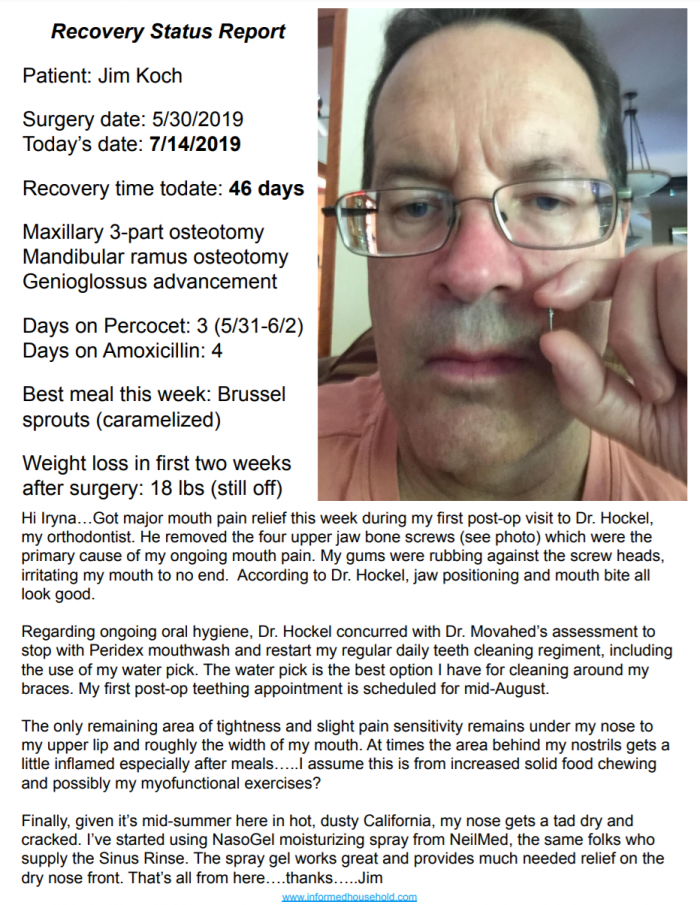

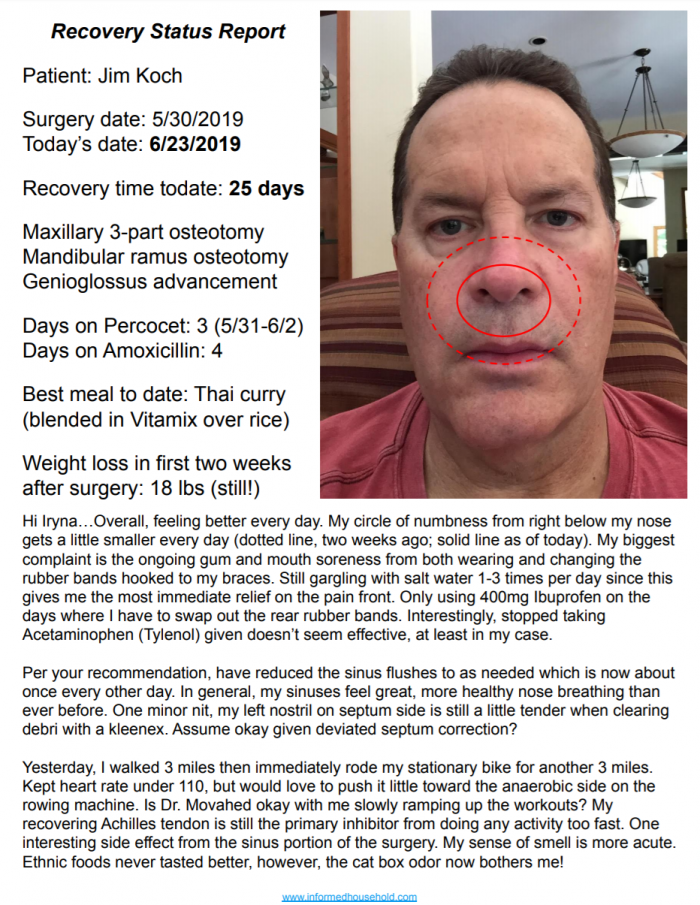

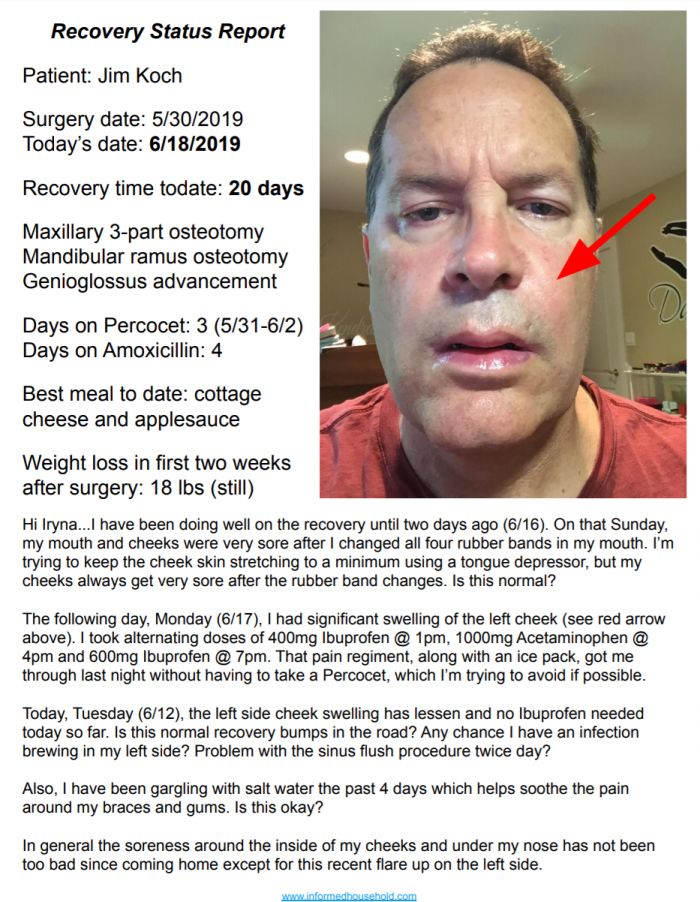

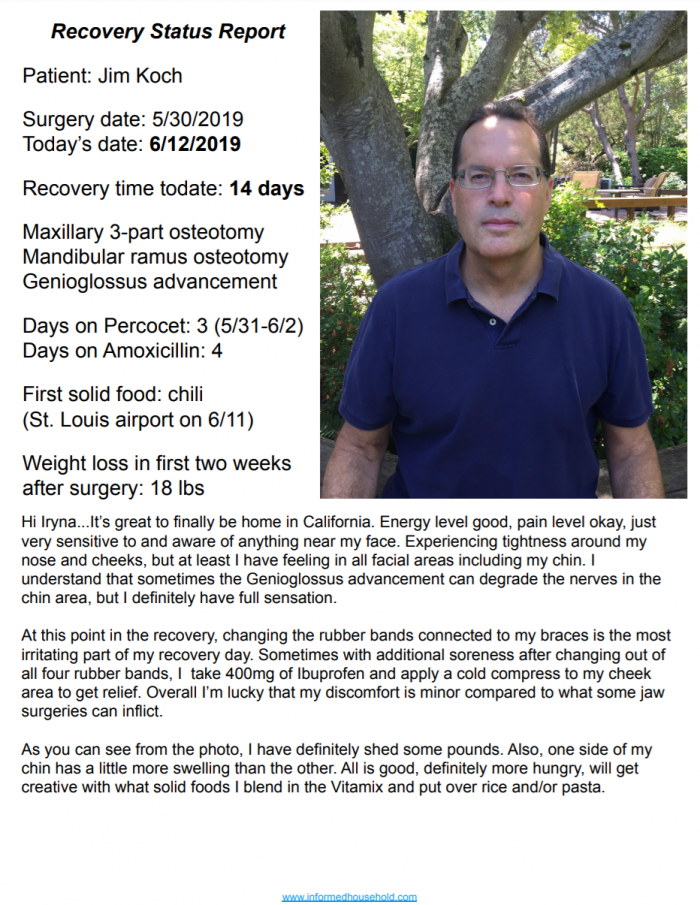

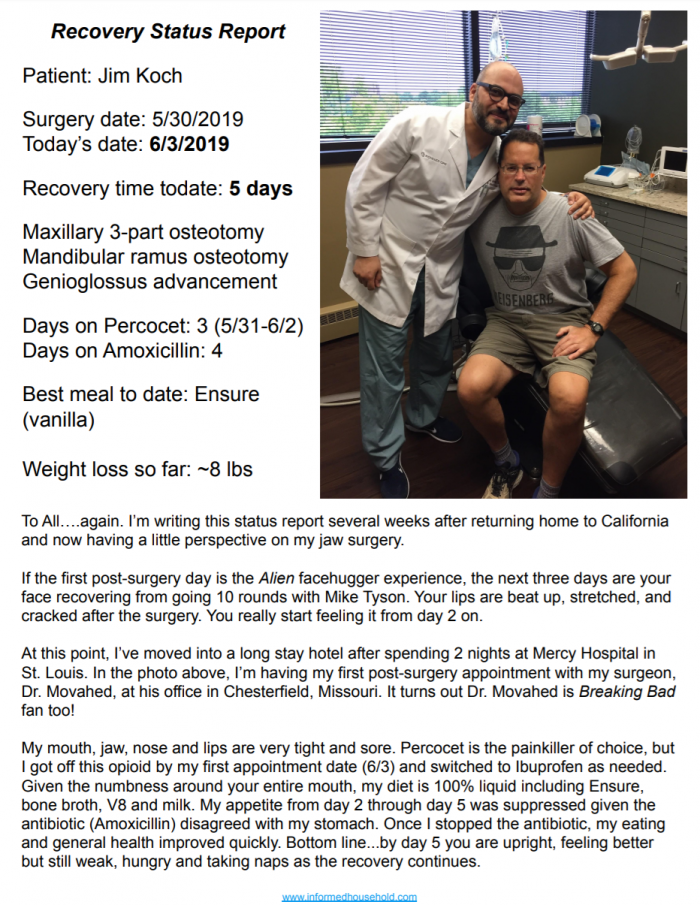

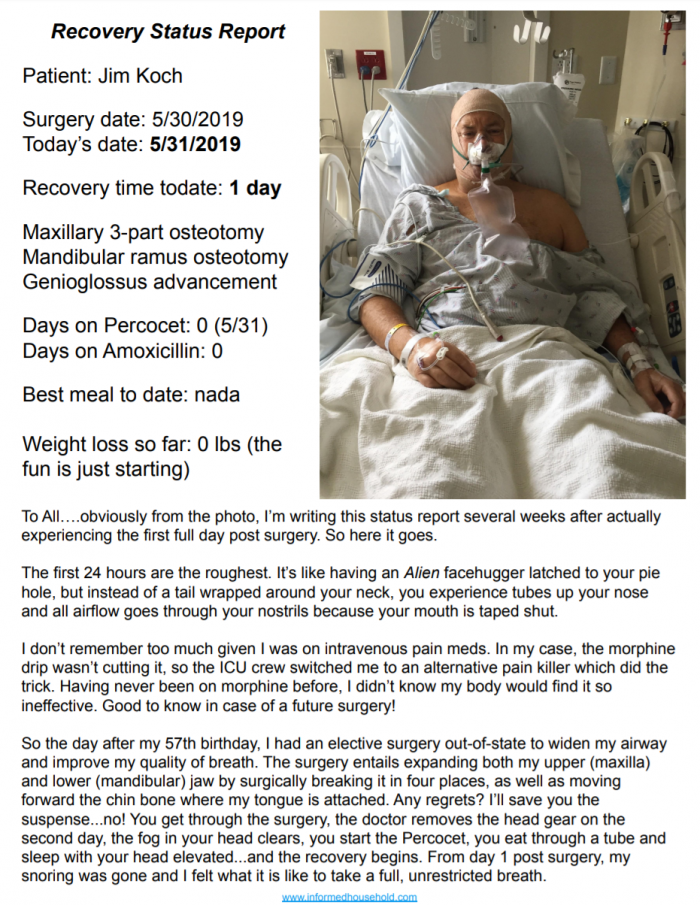

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

How Long Will You Live?

This new longevity calculator, courtesy of the University of Connecticut, is one of the best I’ve encountered to date. Given your estimated longevity is the most influential factor in determining your future spending capacity, I hope you all will give it a whirl. This is an example of big data providing useful results.

How Much Does Healthcare Cost?

This interactive website, courtesy of Genworth, will help you estimate you future medical spending. It provides the latest cost statistics by state for later-in-life home health care, assisted living and nursing care. Please remember that the typical household incurs the bulk of their medical expenses late-in-life which makes budgeting difficult if you have a long lifespan ahead of you.

The Informed Household’s typical expense curve graphic above reminds us that (1) your (and your spouse’s) lifespan significantly impacts all retirement expense categories so please re-evaluate and refine this crucial planning estimate annually. And (2) your medical costs in retirement do NOT trend smoothly up at the general rate of inflation; these expenses tend to spike late-in-life as you approach the pearly gates.

For more information estimating your future medical spending, please see this video, and for a broader discussion on future retirement risks, please watch this video.

I will also add these two calculator links to the “Suggested Third-Party Resources” section of the Informed Household knowledge wall.

Cheers…..Jim

About Jim Koch

Jim Koch is the President of Koch Capital Management, an independent Registered Investment Advisor (RIA), and the Founder and Principal of the Informed Household® financial education and smart budgeting website located in the San Francisco Bay Area. As a fiduciary, he specializes in providing customized financial solutions to individuals, families, trusts and business entities so they are better able to achieve their financial goals. Jim sees himself as an “implementer” of financial innovation, using state-of-the-art technology to provide practical investment management and retirement planning solutions for clients.

General Disclosure

This information is provided for informational/educational purposes only. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions. Nothing presented herein is or is intended to constitute advice to use or buy any of third-party applications presented here, and no purchase decision should be made based on any information provided herein. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Third Party Information

While Koch Capital has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, timeliness, or completeness of third party information presented herein. Any third party trademarks appearing herein are the property of their respective owners. At certain places on this website, live ‘links’ to other Internet addresses can be accessed. Koch Capital does not endorse, approve, certify, or control the content of such websites, and does not guarantee or assume responsibility for the accuracy or completeness of information located on such websites. Any links to other sites are not intended as referrals or endorsements, but are merely provided for convenience and informational purposes. Use of any information obtained from such addresses is voluntary, and reliance on it should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

Please click here to download the one-page status report in PDF format if interested in my surgery recovery progress. The full story is provided in my Quality of Breath post.

The Restrictive Airway Problem

In 2018 I was diagnosed with sleep apnea and facing a slow, multi-year decline in my cognitive abilities from the lack of deep sleep. After completing an extensive sleep study, I discovered that the Continuous Positive Airway Pressure (CPAP) breathing machine, the most common, non-surgical treatment for sleep apnea, wouldn’t suffice in my case. My throat airway was extremely narrow. The CPAP machine running at full volume still could not supply the air flow I needed for sound sleep. My restrictive airway condition was part genetic (inherited jaw malformation), part head trauma (thank you high school football) and part severe tongue-tie (and my tongue attaches far back in my throat, further restricting airflow). Together these related issues severely restricted my volume of air intake on a single inhalation (see colored X-ray chart below).

The restrictive airway issue is more common than you may realize. With the rise of grain cultivation several thousand years ago and more recently large scale farming to support an ever growing global population, the human diet has migrated away from raw, natural food consumption, which requires robust chewing, to more processed and softer foods that are consumed with little or no chewing effort.

Over multiple generations this reduction in jaw exercise has contributed underdeveloped and malformed jaws in our kids. The adult human jaw is now, in general, narrower and positioned further back in our skulls reducing airflow when compared to our pre-industrial age brethren. While cavemen and their young offspring were ripping and tearing meat with their teeth off animal bones, modern humans are sipping lattes and consuming doughnuts, degrading 10 million years of natural jaw development and healthy breathing from our early homo sapien ancestors.

Since modern humans are living longer, many middle-aged adults and seniors are now facing a quality of breath time bomb they may not be aware of. The warning signs are slow to form and not always obvious. I should know. I rowed crew in college and never considered my breathing to be a performance limiting factor, nor anticipated it would become a deep sleep inhibitor later-in-life. When you’re young, the resilient human body can adapt and compensate for the lack of oxygen, but eventually it catches up with you. It eventually caught up with me and specialized surgery was my best option, and arguably the only viable option, to fix my breathing.

Source: Informed Household

Cast of Specialists

Most specialty medical conditions invite a plethora of professional (and casual observer) opinions on how best to tackle this problem, both surgically and nonsurgically. Restrictive airway issues are even more complex with no one specialist that addresses the whole enchilada. Every restricted airway case is unique, potentially requiring a cast of specialists to get the results you desire.

In my case, I’m seeing a jaw specialist who deals with airway issues. But I’m also coordinating with an orthodontist to fix my teeth and bite, a tongue-tie specialist, a myofunctional therapist to improve my nose breathing. Finally, I’m seeing an ENT (Ears, Nose & Throat) specialist to help with related sinus issues.

It’s not easy finding the right players for your restrictive airway solution team. In many cases, your primary care physician doesn’t know where to start and could, but not always, recommend you down a non-productive rabbit hole with the best of intentions. I’ll save you the time and frustration; find and speak with an orthodontist who has referred patients out to an OMF (Oral and Maxillofacial) surgeon in the past and understands the relationship between small, narrow jaw lines and breathing disorders.

As you gather your team together, make sure each specialist is willing to share your medical data and coordinate the various treatments. There is no single health provider that I could find that offers a fully-integrated solution in house. And frankly, you probably want the ability to pick and choose the best in breed for each specialty that your unique condition requires. I just wish the medical establishment would take a page from the tech industry and utilize a communication sharing tool like Slack to better coordinate all treatment phases – pre-surgery, surgery and post-surgery – between the patient and the doctors.

Good Health, Good Retirement

In my financial advisory practice, I help clients save for retirement and prepare for the unexpected. Given my excellent surgical outcome, I’m immensely relieved not to have to worry about creeping cognitive decline as I age due to a breathing issue. I have very active teen kids and want to remain active myself, not too mention continue my lifestyle pursuits (travel, family, learning, fishing, charity, etc.) with my wife.

This whole experience re-enforced my planning philosophy that every household needs a cushion (emergency fund) to tackle whatever life throws their way. More often than not unexpected expenses are usually medical related and occur more frequently as you age. My wife and I were planning to use our HSA savings to help fund late-in-life medical expenses and possibly long-term care for the surviving spouse. Since we funded my jaw surgery with our HSA savings, we have substantially depleted ten years of diligent HSA savings and investment growth. But it was money well spent and we still have time to rebuild our HSA account. I’m thankful we had the HSA cushion since my health insurance provider would not pay for this out-of-network procedure. BTW…I will devote later blog posts to cover the cost specifics of jaw surgery, dealing with the insurance side, and how to spend an HSA efficiently to get the most bang for your medical savings buck.

We’re not in Kansas anymore! (click image or here to watch video)

Measuring Results

In addition to my Koch Capital advisory practice, I run a financial education and smart budgeting website called the Informed Household. One of the Informed Household’s core principles is the importance of measurable results to encourage positive financial behavior change, whether saving for college or planning for the unexpected. So to walk-the-talk myself, I developed my own five success criteria to evaluate my jaw surgery outcome.

The 2x increase in my airway size is a straightforward measure since the jaw surgeon’s office captures pre-surgery and post-surgery 3D images of your airway. Here is my post-surgery x-ray.

Source: Informed Household

From the before and after minimum volume measurements, I went from 98 to 186mm2, almost a 2x expansion which brought my airway size well into the normal range. This volume improvement was very important to me. If you are going to undertake a tough surgery with a long recovery period, you want the result to be impactful not just a marginal improvement.

I’m going to be polite here, but prior to selecting my jaw surgeon, Dr. Movahed, and his surgical approach, I was presented with other surgical and non-surgical airway options from other doctors that at best would marginally improve my breathing and most likely require a surgical option later and possibly multiple surgeries. I chose the most comprehensive solution route; fix all issues with a single surgery resulting in a longer post-surgery recovery period versus an incremental approach providing marginal relief now and the possibility of a future surgery down the road.

The second criteria, minimal snoring, was achieved immediately. My snoring disappeared the next day after surgery, even with significant nose area swelling. As of today, a month plus after my surgery, still no snoring and my wife has ditched her ear plugs.

The third criteria, sleeping with your mouth taped, is not only an important breathing health indicator but also an important ongoing good health practice. Regarding the latter, I was a big mouth breather given my restricted airway and sinus issues. The human body is designed to breathe through the nose and there are many documented benefits for doing so. The taping of one’s mouth when you go to bed at night helps your body relearn to breathe through your nose and achieve a deeper level of sleep.

As to the former, mouth taping is an easy test to see if you are a mouth breather and possibly have a restricted airway condition. Try it and if can’t sleep with you mouth taped shut, go see a sleep specialist to determine why. Before surgery, I couldn’t sleep with my mouth taped shut. Once my face swelling has subsided, I will retest this criteria and report back.

The fourth success criteria, retain facial skin feeling, is unique to this surgery. In particular, the Genioglossus advancement procedure moves your chin bone, where your tongue attaches, forward to reduce blockage of the tongue resting too far back in your throat. By moving my tongue forward, as well as relieving the tongue-tie condition (which I did earlier in this journey), this treatment combination substantially opened up my airway. However, one common undesired consequence of the Genioglossus advancement can be the permanent loss of touch sensation in your chin and lower cheek area. The advancement stretches the nerve(s) in your chin, possibly resulting in loss of feeling. I was fortunate that I retained all feeling in my cheek and chin areas.

Finally, the fifth success criteria, the 100-yard butterfly swim, will be the most interesting success criteria to measure. I started “coached” swimming in my fifties at a local masters swimming club. While I previously swam freestyle, the breast, back and butterfly strokes were new to me. I quickly noticed how much more breathing intensive the butterfly was in relation to the other strokes. It took me several years to progress to completing multiple laps (25 yards) swimming the fly. Granted my butterfly stroke is a tad ugly, but I was definitely experiencing oxygen debt during the last (fourth) lap, leading to an extremely sloppy finish to my 100-yard swim. With my new and improved airway, the increased air intake should translate to more stamina during the fourth lap of my butterfly swim. We’ll see. Unfortunately, no swimming post-surgery for 3 months per doctor’s order given the chance of infection. Once I’m back in the pool, I need several months to get back into swim shape, so this criteria will be my last to test and report back on.

Again, measurable results are import feedback indicators for change in any big endeavor you undertake, whether it be financial or health related. As management guru Peter Druker reminds us – “if you can’t measure it, you can’t improve it.”

Post Surgery Recovery

Since my jaw surgeon (Dr. Movahed) is located in St. Louis and I live in California, I started documenting my recovery progress, which I synthesized into weekly, one-page status reports. I emailed these reports to Dr. Movahed’s post-surgery assistant (Iryna) for review and received her and Dr. Movahed’s feedback weekly.

I’m posting these status reports in my Informed Household blog for anyone interested in seeing what the post-surgery recovery entails. Just click on the “Quality of Breath (n)” link in the Informed Household Topics right side navigation search box to retrieve the entire blog series.

I welcome any feedback and comments, and will do my best to respond to all surgery-related questions. Warning on the photos; it’s not a pretty sight early on, but hopefully the visuals and the narrative will provide useful information for those contemplating a surgical option for correcting their restrictive airway condition.

Thank you for indulging me and may the breath be with you…..Jim (jim@informedhoushold.com)

P.S. My skull x-rays before and after surgery; can you say titanium!

About Jim Koch

Jim Koch is the President of Koch Capital Management, an independent Registered Investment Advisor (RIA), and Founder and Principal of the Informed Household financial education and smart budgeting website located in the San Francisco Bay Area. As a fiduciary, he specializes in providing customized financial solutions to individuals, families, trusts and business entities so they are better able to achieve their financial goals. Jim sees himself as an “implementer” of financial innovation, using state-of-the-art technology to provide practical investment management and retirement planning solutions for clients.

General Disclosures

This information is provided for informational/educational purposes only. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions. Nothing presented herein is or is intended to constitute advice to use or buy any of third-party applications presented here, and no purchase decision should be made based on any information provided herein. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Third Party Information

While Koch Capital and the Informed Household have used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, timeliness, or completeness of third party information presented herein. Any third party trademarks appearing herein are the property of their respective owners. At certain places on this website, live ‘links’ to other Internet addresses can be accessed. Koch Capital and the Informed Household do not endorse, approve, certify, or control the content of such websites, and does not guarantee or assume responsibility for the accuracy or completeness of information located on such websites. Any links to other sites are not intended as referrals or endorsements, but are merely provided for convenience and informational purposes. Use of any information obtained from such addresses is voluntary, and reliance on it should only be undertaken after an independent review of its accuracy, completeness, efficacy, and timeliness.

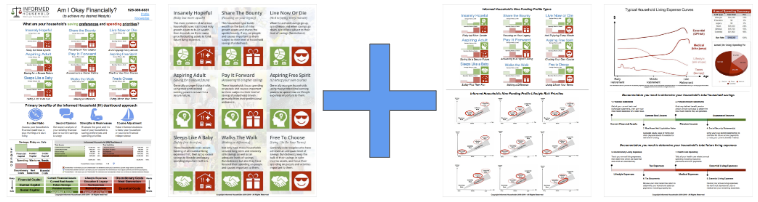

I recently updated the Informed Household Infographic PDF from its original 2-page format to an expanded 4-page format to include more details on the nine funding profile types. The additional pages address the lifestyle risk priorities for each funding profile type as well as provide the typical discretionary vs. essential expense curves retirees normally experience during their lifespans.

Now it’s all in one place, in one PDF available for download here. And please remember that most the graphics contained within the PDF are hyperlinked to additional video resources for your convenience.

Retirement planner and blogger Dirk Cotton gets right to the point. Retirement planning is complex and difficult to know where to start.

His recent Forbes blog post succinctly explains the basic trade-offs between the two main retirement planning camps: safety-first and probability-based. In the Informed Household parlance, this corresponds to Sleeps Like A Baby and Insanely Hopeful funding profiles.

Enjoy the the article, it’s very informative…..Jim

Meet Ashley (66) and Louis (68) of Montana, our fictitious Free To Choose couple whose savings preferences and spending priorities we analyze to see how this household is doing on its journey to financial independence.

Please click here to download the PDF analysis and here to watch the video.

Thank you for viewing……Jim Koch

Meet Christina (26) and Sean (28) of Iowa, our fictitious Aspiring Free Spirit couple whose savings preferences and spending priorities we analyze to see how this household is doing on its journey to financial independence.

Please click here to download the PDF analysis and here to watch the video.

Feedback always welcome….enjoy…Jim Koch